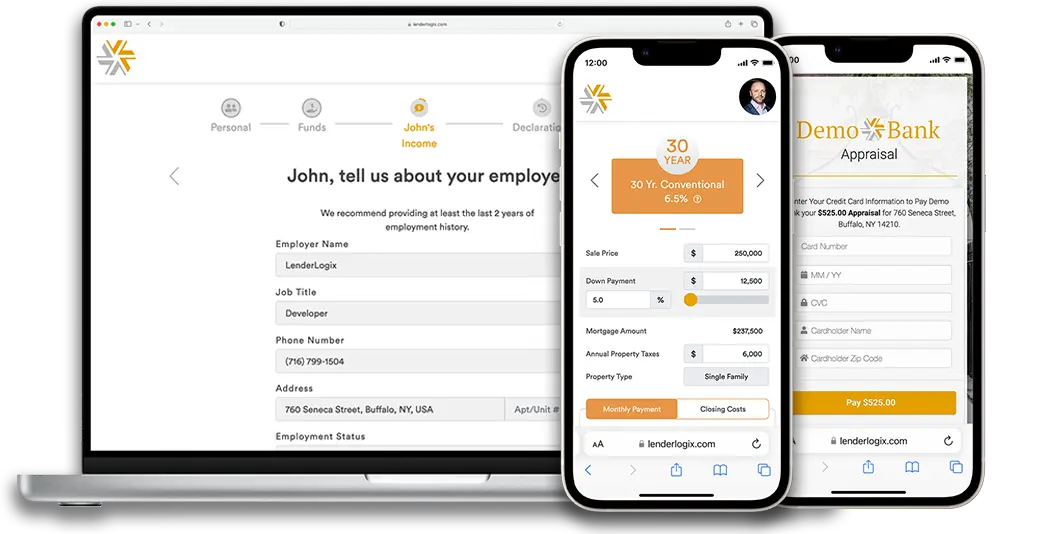

Simplifying Mortgages, Empowering Lenders

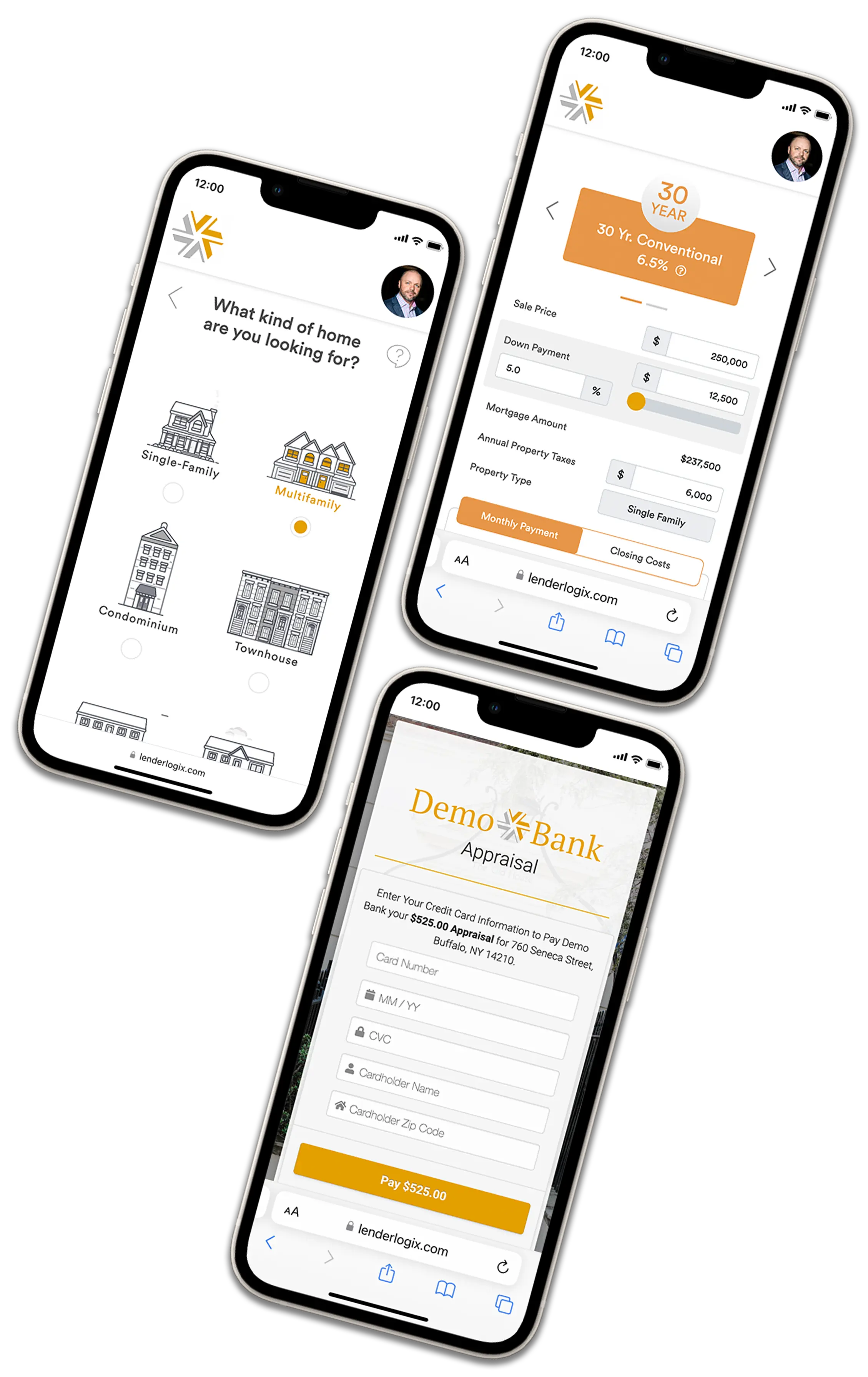

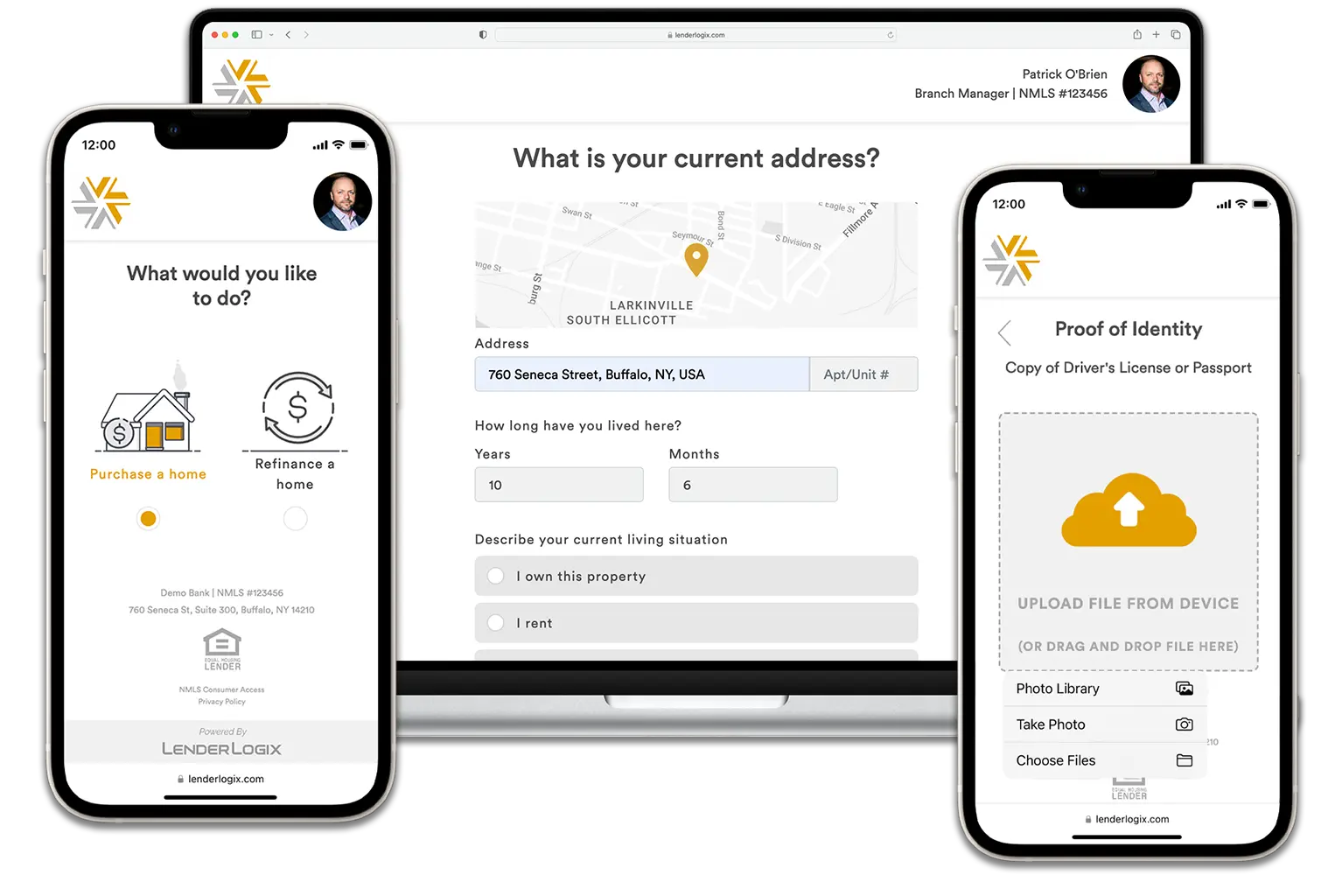

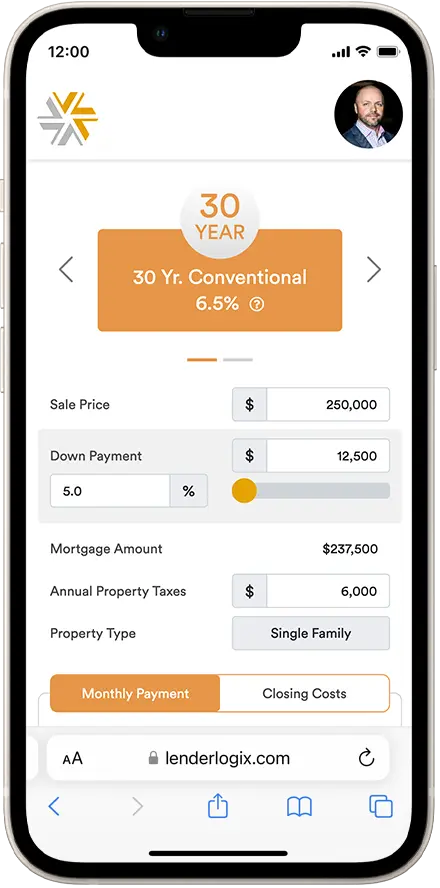

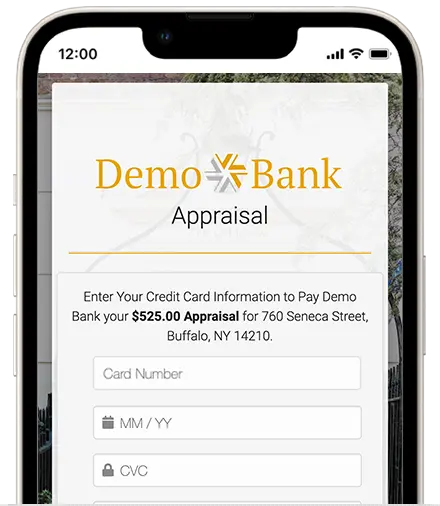

Solutions for every step of the home lending journey.

LenderLogix™ delivers API-crafted, intuitive tools, enhanced with AI-driven efficiency, that engage borrowers, streamline workflows, and drive real results for modern lenders using Encompass®.