Transform Your Mortgage Lending with LiteSpeed™

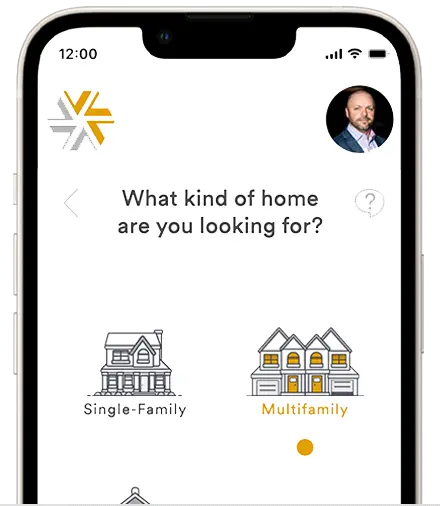

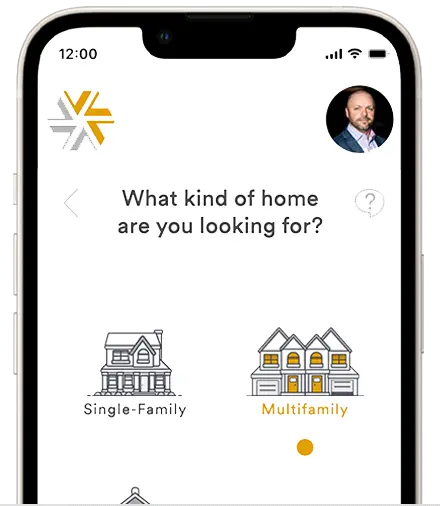

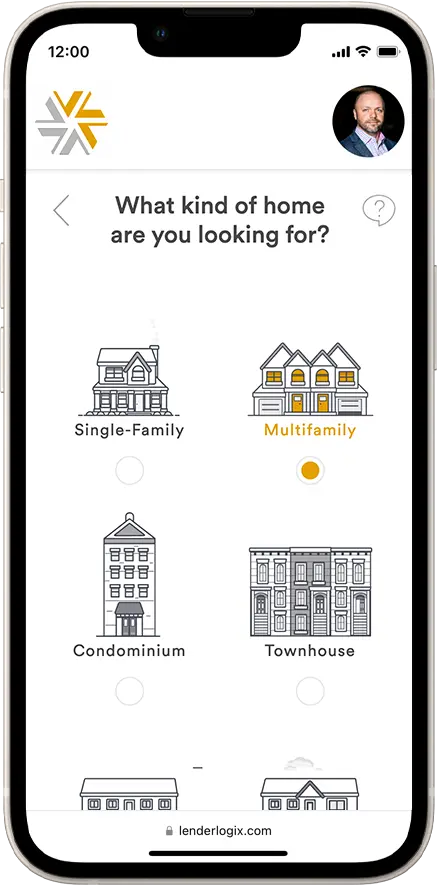

LiteSpeed is the mortgage Point of Sale purpose-built for Encompass® users, enhanced with AI-driven intelligence to help lenders work faster and smarter. Deliver a seamless mortgage experience that adapts to every borrower with intuitive document collection and automated insights that keep your pipeline moving.

Empower borrowers, loan officers, and processors with an AI-assisted, API-based solution that accelerates leads, completes applications faster, and simplifies document management, all at an affordable price and ready to deploy in weeks.

Lenders across the country using LiteSpeed receive initial application information from over 50% of the visitors to their LiteSpeed page.

Lenders across the country using LiteSpeed receive initial application information from over 50% of the visitors to their LiteSpeed page.

Lenders using LiteSpeed see 75% of their LiteSpeed files receive an uploaded document via the secure upload link within 24 hours.

Lenders using LiteSpeed see 75% of their LiteSpeed files receive an uploaded document via the secure upload link within 24 hours.