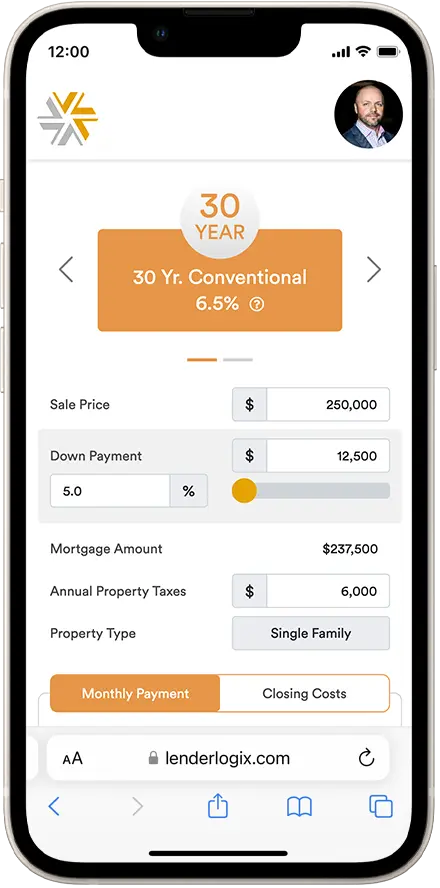

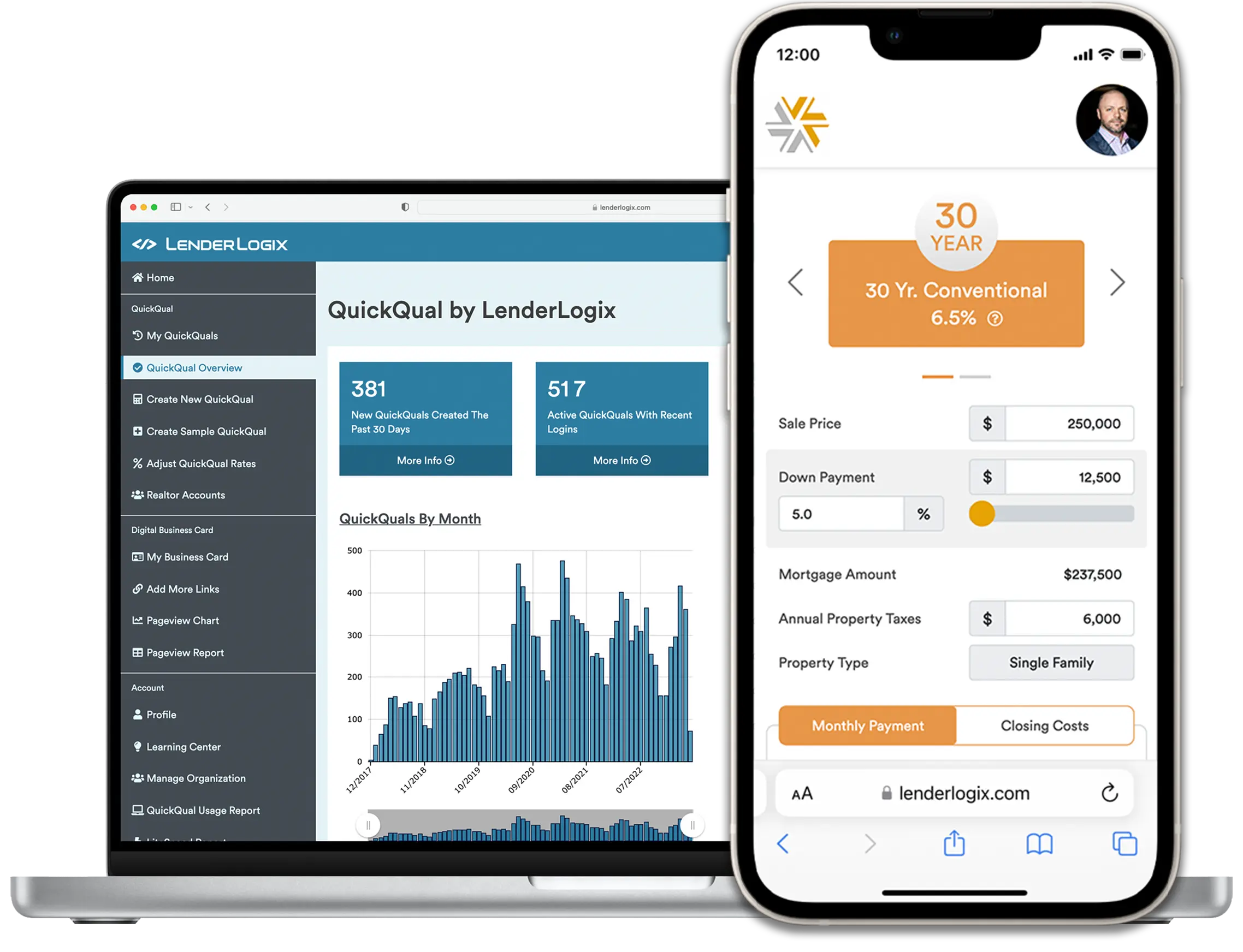

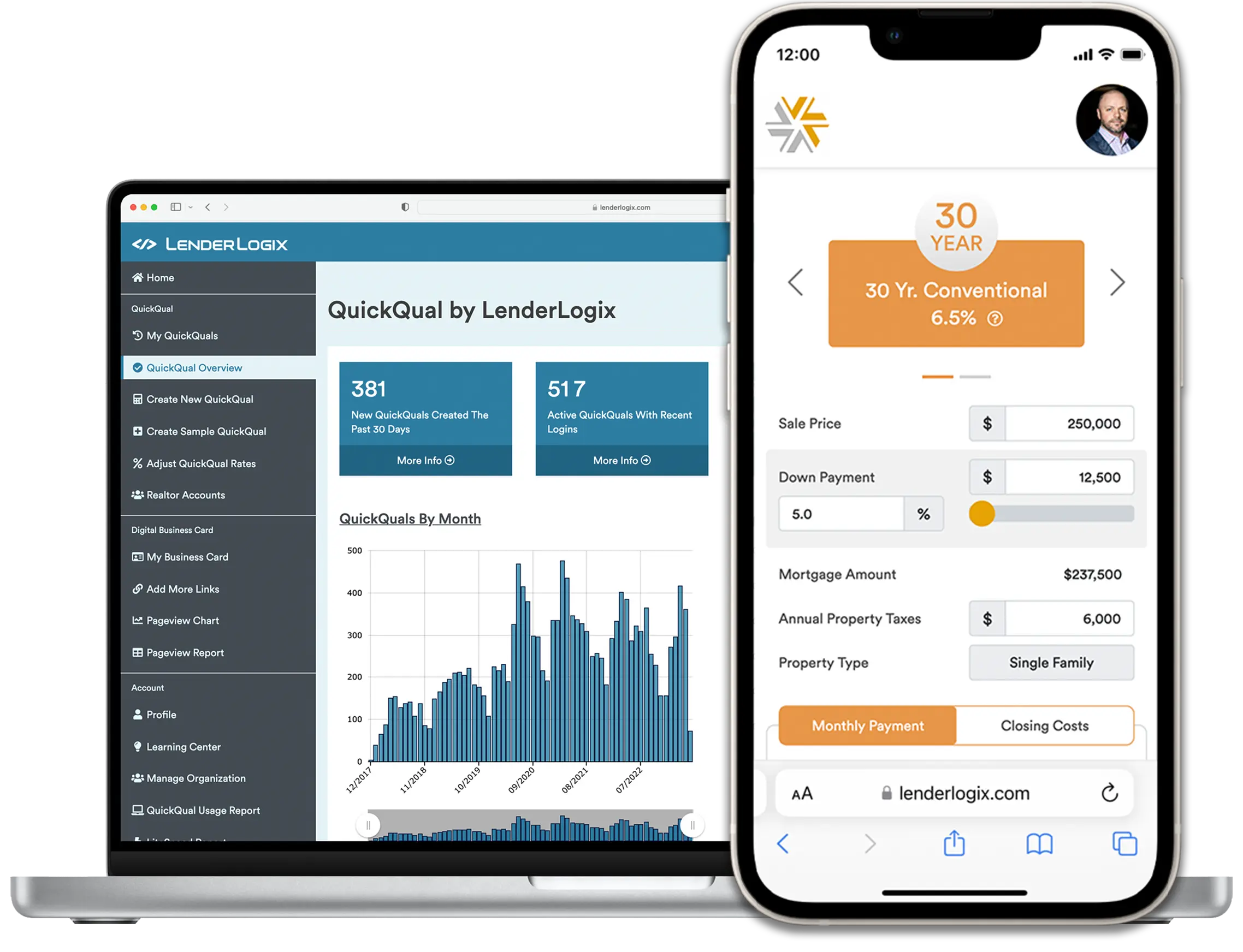

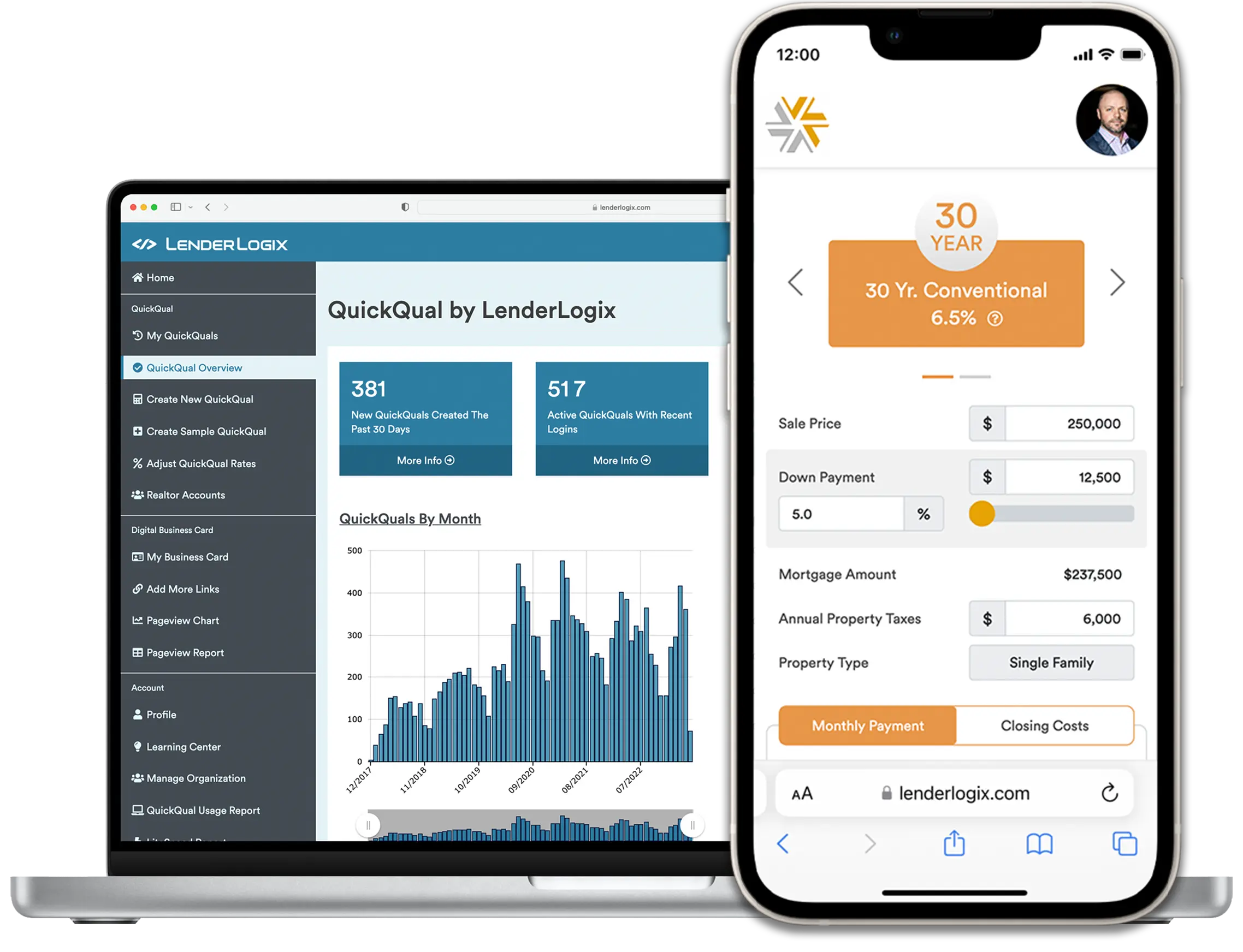

Pre-approvals that drive conversions and grow business

QuickQual™ is the industry's only API enabled Loan Origination System add-on that gives homebuyers and Real Estate partners access to a hyper-focused, borrower specific, payment calculator that offers closing cost scenarios, side-by-side comparison of loan products and the ability to update letters as they shop for their dream home.

QuickQual users see an average increase in their pre-qualification to application conversion rate of 30%.

QuickQual users see an average increase in their pre-qualification to application conversion rate of 30%.